Table of Contents

Incoming Payments #

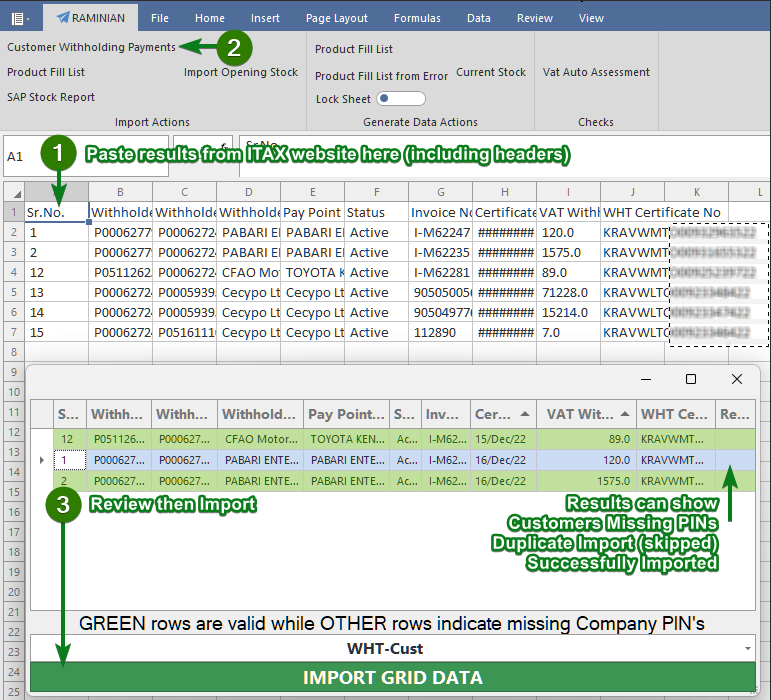

Payments of VAT Withholding made to you, are shown on the ITAX website.

These can easily be imported into Raminian!

- From the itax portal, click on Certificates > Reprint withholding certificates and load the report by selecting the correct month and date.

- Click Consult to load

- Select all rows including the header

- COPY the selection (you may need to click CTRL+C)

To Import

- In Raminian, click on Tools > Sheets

- PASTE into the first cell (A1)

- Under import actions, click on Customer Withholding Payments

- A new window will pop up with the data. Raminian will ensure that duplicate entries are not created and only customer payments will be imported, as shown in the below screenshot.

Outgoing Payments #

Calculating the value to withhold #

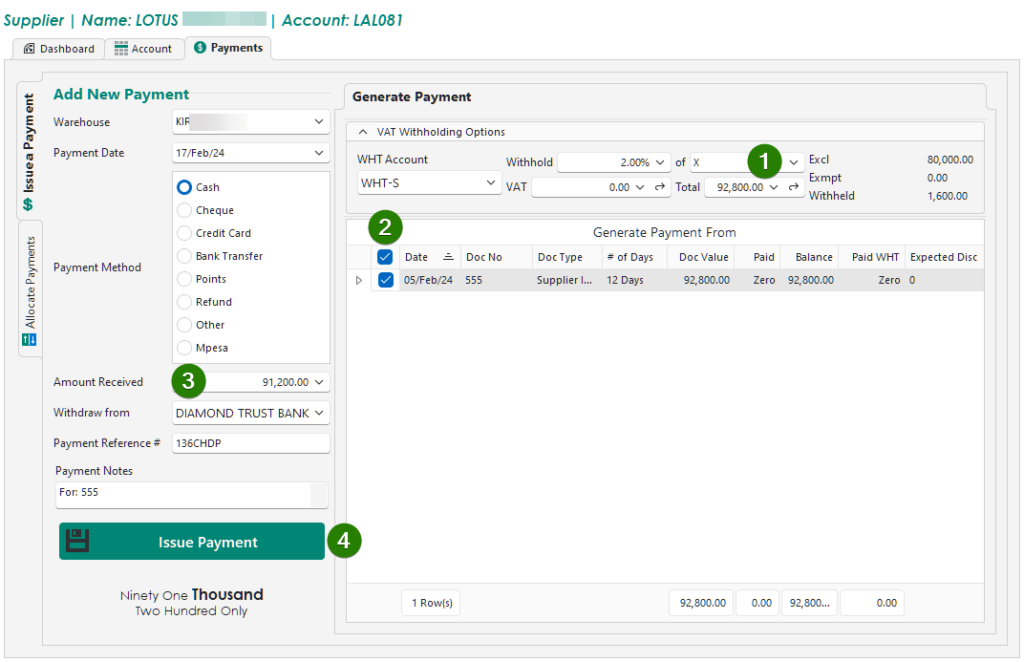

When issuing payments to suppliers, you may need to withhold 2% of your vattable sales. With Raminian, it’s super easy! Follow the below instructions;

2. Select the documents to issue payments for. Note that here, you are withholding 1,600/- of a total of 92,800/-

3. Confirm payment details and (4) issue your payment

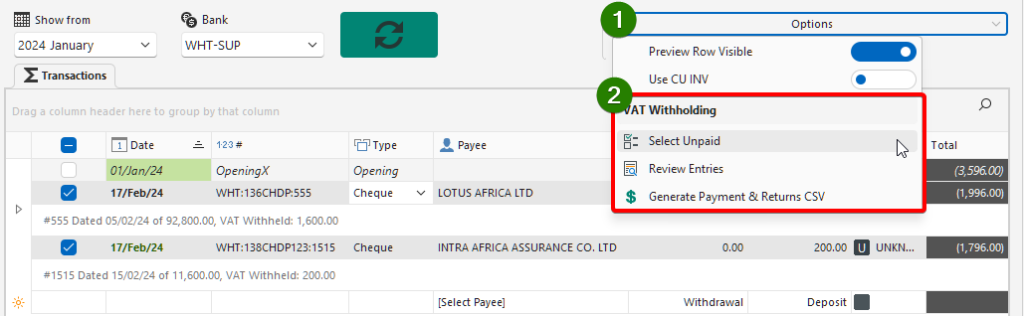

Check how much to pay KRA (withheld value) #

1. Select Options

2.

SELECT UNPAID – will select all withheld values which are yet to be processed to KRA

REVIEW ENTRIES – shows a review window which allows you to replace Purchase Orders with correct Supplier Invoices (for returns references)

GENERATE PAYMENT – will set all selected rows as paid and generate a single WITHDRAWAL value from this holding account, which shows you the value to issue to the tax authority.