As a requirement from KRA, the TIMS device needs a reference to the Contol Unit Invoice number (CU INV) issued on the ORIGINAL SALE which is being credited for. Also note;

- Product Names must be the same as those being credited

- Quantity and Rate must not exceed that of the original sale

The above is checked using the Relevant Invoice Number (RIN) field which must be provided with each credit note. Only ONE RIN can be added per credit note.

This means that you cannot issue a credit note for end-of-month rebates, “price difference” or bulk credit notes from “target discounts” or such.

TIMS PARSER – Issuing Credit Notes #

Credit Note issuing can be fully automated if your template includes the RECEIPT NUMBER (from your software) of the original sale.

If a reference cannot be provided, then, the following steps should be taken;

- Print the Credit Note, the same way as a sale (saves a PDF file of the credit note)

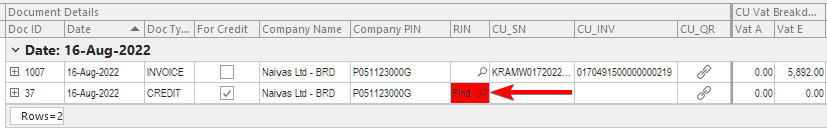

- Click on the RED highlighted cell when searching for documents as shown below:

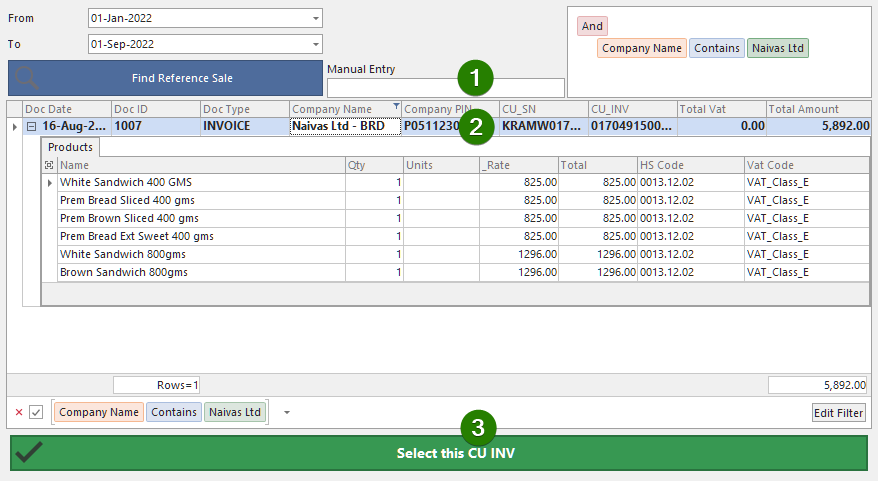

- Enter the CU INV number manually (Step 1) or search for the original sale as shown below (Step 2 and 3)

- Click START to process the pending credit note (which now has a reference to the original sale, as required).

Credit Note Calculations with Discounts #

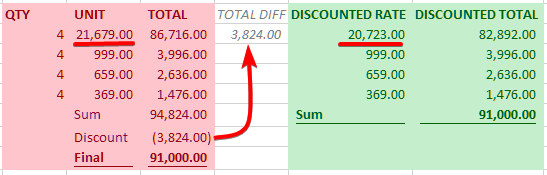

Red Area – Sale: The above example has a TOTAL DISCOUNT for the 4 items sold.

The discount is distributed according to the order of largest total, which results in the first item reducing by 3,824.00.

Green Area – Credit – If there’s a Credit Note for just one item, the discount distribution may not match. So a credit note for the first item, for example, for total of 86,716/- would not be possible, as each item’s rate, would be 21,679, which is more than what passed through the ETR (20,723).